Publications

Textual Uncertainty in Financial Disclosures and Information Asymmetry among Investors

Financial Review, 2025

with Rasheek Irtisam and Pankaj K. Jain

Abstract: Prior literature documents a temporary increase in information asymmetry between sophisticated and unsophisticated traders around earnings announcements and management forecasts. This increase occurs because sophisticated traders can capitalize on released information relatively quickly. In this study, we find when management uses more ambiguous tone in 10-K and 10-Q filings, the resulting spike in information asymmetry around the filing window is significantly lower than for firms which use less ambiguous tone. This suggests sophisticated traders are less able to extract useful information from financial disclosures when management itself is less certain about the prospects of the firm. Similarly, when financial statements are less readable, the resulting spike in information asymmetry is also lower.

Economic Policy Uncertainty and Corporate Bond Liquidity

Journal of Banking & Finance, 2025

with Nirmol C. Das and Diego L. Gonzalez

Abstract: We find elevated Economic Policy Uncertainty (EPU) is associated with reductions in corporate bond dealer inventories and worsening liquidity, suggesting bond dealers react to increased inventory risk by reducing their capital commitments and compensating themselves via increased transaction costs. A one standard-deviation increase in EPU is associated with a 1.83% widening in bid-ask spreads, 3.06% increase in Amihud illiquidity and 1.33% reduction in average inventories. This effect is less pronounced in small firms, speculative-grade bonds, illiquid bonds, and calmer markets, suggesting that EPU affects bond liquidity more when macroeconomic –not idiosyncratic – factors are the primary determinant of a bond’s risk.

Reproducibility in Management Science

Management Science, 2024.

with Miloš Fišar, et al.

Abstract: With the help of more than 700 reviewers we assess the reproducibility of nearly 500 articles published in the journal Management Science before and after the introduction of a new Data and Code Disclosure policy in 2019. When considering only articles for which data accessibility and hard- and software requirements were not an obstacle for reviewers, the results of more than 95% of articles under the new disclosure policy could be fully or largely computationally reproduced. However, for 29% of articles at least part of the dataset was not accessible to the reviewer. Considering all articles in our sample reduces the share of reproduced articles to 68%. These figures represent a significant increase compared to the period before the introduction of the disclosure policy, where only 12% of articles voluntarily provided replication materials, out of which 55% could be (largely) reproduced. Substantial heterogeneity in reproducibility rates across different fields is mainly driven by differences in dataset accessibility. Other reasons for unsuccessful reproduction attempts include missing code, unresolvable code errors, weak or missing documentation, but also soft- and hardware requirements and code complexity. Our findings highlight the importance of journal code and data disclosure policies, and suggest potential avenues for enhancing their effectiveness.

Review of Quantitative Finance and Accounting, 2023.

with Pankaj K. Jain and Wei Sun

Abstract: We introduce an intraday measure of trade-time clustering which estimates periodic grouping of trades, integrating volume and trade duration. This measure consistently detects informed trading superior to volume and duration. We find that in stable markets, both lagged information flow and liquidity are positively associated with trade-time clustering, while in volatile markets only lagged liquidity is. Trade-time clustering is positively associated with contemporaneous price impact, price volatility, and market efficiency, suggesting that trade clustering contributes to price discovery. Following increased trade-time clustering, we observe more aggressive orders from informed traders, but less high-frequency trading in stable markets.

The Life of U’s: Order Revisions on NASDAQ,

Journal of Banking & Finance, 2020.

with Olena Nikolsko-Rzhevska and Alex Nikolsko-Rzhevskyy

Abstract: By recovering data on individual revision “U”-messages on NASDAQ, this paper is the first to reconstruct and then examine the chains of order revisions. In recent years, revisions have grown in popularity and now are thrice as common as executions. The research on revisions, however, is practically non-existent. We find significant differences between revisions and cancellations/placements as order updating techniques. Our results also show that while traders appear to respond rationally to new information by updating their orders, there exist stable predictable patterns in the behavior of order revisions. Additionally, there is evidence of deleterious effects of revisions on market quality.

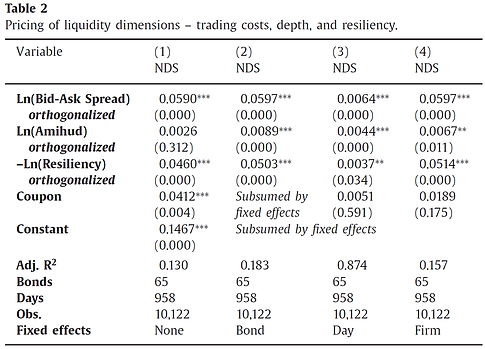

The Pricing of Different Dimensions of Liquidity: Evidence from Government Guaranteed Bank Bonds,

Journal of Banking & Finance, 2016.

with Duane Stock and Pradeep K. Yadav

Abstract: There are three important dimensions of liquidity: trading costs, depth, and resiliency. We investigate the relevance of each of these three dimensions of liquidity – separately and in conjunction – for the pricing of corporate bonds. Unlike previous studies, our sample allows us to cleanly separate the default and non-default components of yield spreads. We find that each of the above three dimensions of liquidity are priced factors. Of the 21 basis point mean non-default spread, an average of 7.25 basis points are attributable to resiliency, 2.5 to transaction costs, and 0.6 to the depth dimension. We also find that both bond-specific and market-wide dimensions of liquidity are priced in non-default spreads. Finally, we find that there does exist in some periods a small residual non-default yield spread that is consistent with an additional “flight-to-extreme-liquidity” premium reflecting investor preference for assets that enable quickest possible disengagement from the market when necessary.

Director Networks and Firm Value,

Journal of Corporate Finance, 2024.

with Tor-Erik Bakke, Hamed Mahmudi, and Scott Linn

Abstract: Are the professional networks of corporate directors valuable? More connected directors may have better information and more influence, which can increase firm value. However, these directors may also be busy or spread value-decreasing practices. To separate the effect of director networks on firm value from the effect of other value-relevant director attributes, we use the unexpected deaths of directors as a shock to the director networks of interlocked directors. By studying the announcement returns and using a difference-in-differences methodology, we find that this negative shock to director networks reduces firm value. This evidence suggests that director networks are valuable.

Journal of Finance, 2024.

with Albert J. Menkveld, et al.

Abstract: In statistics, samples are drawn from a population in a data-generating process (DGP). Standard errors measure the uncertainty in estimates of population parameters. In science, evidence is generated to test hypotheses in an evidence-generating process (EGP). We claim that EGP variation across researchers adds uncertainty: Non-standard errors (NSEs). We study NSEs by letting 164 teams test the same hypotheses on the same data. NSEs turn out to be sizable, but smaller for better reproducible or higher rated research. Adding peer-review stages reduces NSEs. We further find that this type of uncertainty is underestimated by participants.

The Impact of Make-Take Fees on Market Efficiency,

Review of Quantitative Finance and Accounting, 2022.

Abstract: Recently, stock exchanges have altered their trading fees to subsidize liquidity by offering “make” rebates for providing liquidity through limit orders and charging “take” fees for consuming liquidity via marketable orders, leading to debate regarding the impact of these fees on market quality. Using an exogenous experiment performed by NASDAQ in 2015, I employ difference-in-differences analysis on a matched sample and find that a decrease in take fee and make rebate levels leads to greater absolute pricing error and larger variance of mispricing. This stems from widened bid-ask spreads and decreased informed trading by retail investors.

How a Credit Enhancement Affects Bond Liquidity and Default Risk of the Firm,

Journal of Fixed Income, 2019.

with Seth A. Hoelscher and Duane Stock

Abstract: We use a quasi-natural experiment to analyze the impact of a particular type of credit enhancement, a government guarantee, on bond liquidity and default risk of the firm. We find that a guarantee (1) dramatically increases the liquidity of a bond, (2) generally reduces the default risk of the firm and pre-existing bonds issued by the firm, and (3) increases the liquidity of pre-existing non-guaranteed debt issued by the same firm. We find that the liquidity improvement caused by a guarantee reduces overall default risk of the firms by 5.84%.

Return Dynamics and Trading Strategy in Alternative Trading Systems,

Journal of Trading, 2012.

with Hong Miao and Sanjay Ramchander

Abstract: This article examines intra-day price relationships between electronic and floor (pit) trading markets for the S&P 500 and Nasdaq 100 equity index futures. The two contracts trade in dual open outcry and electronic platforms during non-overlapping trading hours. The results indicate that closing transactions on the electronic market have a systematically negative influence on the opening prices established on the pit. In contrast, pit prices at the end of the regular trading have a positive, but less pronounced impact on the opening prices established in the electronic exchange. Based on this relationship, we document a profitable high-frequency trading strategy that can only be partly explained by macroeconomic news.